How does investing at PeerCredit work

We work hard to provide our lenders with easy and potentially profitable investments. Before you start investing, please read the following information and make sure that you understand how investing at PeerCredit works and what the potential benefits are. Please also read the risk page in full.

Peer-to-peer lending is a way to invest money and potentially earn great returns. We employ various risk management activities with the aim of protecting the capital and earnings of our lenders. However, please be aware that by investing at PeerCredit your capital is at risk and instant access is not guaranteed. There is no FSCS protection on the loans made.

Investment in consumer loans of approved borrowers

PeerCredit is a peer-to-peer lending platform. We connect people who want to invest with people who need a loan. As a lender at PeerCredit, you invest directly in loans of borrowers who have passed our credit scoring and whose eligibility for a loan has been approved. When and if the borrowers repay, you get back your capital and potentially earn returns as borrowers are due to pay an interest rate according to their risk profile.

- People who want to invest deposit their money at PeerCredit

- People who want to borrow submit a loan application at PeerCredit

- We approve the creditworthy borrowers and match them with lenders

- The borrowers must regularly repay the loan together with agreed interest rate

- The lenders are being paid back and earn interest from repayments of borrowers

Our role is to provide a marketplace where individual borrowers and lenders can meet and lend and borrow to and from each other. We provide the technical solution to match loans with investments, and we deal with the necessary legal matters in respect of the loan agreements; debt recovery included.

How does investing work

To start investing at PeerCredit, you simply need to create a free account at www.peercredit.com and deposit the desired amount of money. Your investments will be held in a client account and then be distributed across all loans on the platform. We have developed an innovative algorithm for matching investments with loans to improve the success of your investment and increase the liquidity of investments. It works as follows:

-

1. As you invest, you get your share in the PeerCredit Simple lending pool

We operate a Simple lending pool that represents all investments and incoming payments from borrowers that have not been withdrawn by lenders. Simply put, the pool is the total volume of actively invested money + money waiting to be invested.

-

2. Your share is the proportion of your investment to the total pool volume

As you invest, you obtain a share in the pool. Your share is the proportion of your investment to the total volume of the pool. For example, if the total volume of the pool is €100,000 and your investment is €1,000, your share of the pool is 1%.

-

3. Your portfolio is being dynamically invested in all existing loans

In this way, all lenders have a share in all existing loans at the platform. Investments and loans are rematched on a daily basis so each time a new loan is approved by us, you get a share in this loan as well. This has the effect of mitigating the risk of your investments because the return of your capital and earnings don’t depend on a particular number of borrowers. Your portfolio is diversified dynamically over time.

-

4. You get back a portion of your capital and earn interest each time any of the borrower repays

Your earnings are calculated according to your share (calculation is described in the next section). For example, if your share is 1% and a repayment of €550 arrives, you are paid €5.50. Let’s say the repayment consists of €514.02 repayable principal and €35.98 repayable interest. Then you get back your invested capital of €5.14 and a return of €0.36. Repayments are made throughout the whole month, so you are continuously getting back parts of your capital and earn interest.

-

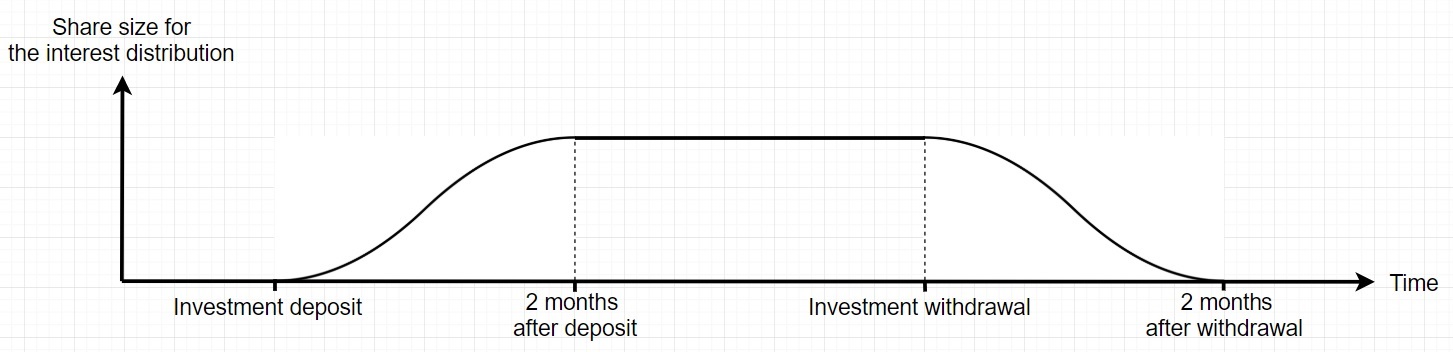

5. Your share in the investment pool is calculated over the last 2 months

For the purpose of interest distribution we consider your contribution in the investment pool over the last 2 months, this is to make the distribution more fair and appropriate:

A new deposit earns lower interest during the first 2 months, then it will earn its full potential. However, the investor does not lose due to having a lower interest at the beginning, as he will be getting interest for another 2 months after the funds are withdrawn.

A new deposit earns lower interest during the first 2 months, then it will earn its full potential. However, the investor does not lose due to having a lower interest at the beginning, as he will be getting interest for another 2 months after the funds are withdrawn.

The reasons for using this kind of interest distribution are described in this article.

Mechanisms implied to mitigate the risk of your investment

Please be aware that despite the multiple safety mechanisms, your capital is at risk; there is no FSCS protection on the loans made and instant access is not guaranteed. To lower the risk of capital loss, we have implemented several safety mechanisms:

-

1. Proper checking of borrower creditworthiness

Before we approve someone for a loan, we check their creditworthiness using various sources of information. We have developed an innovative credit check procedure that combines standard approaches with cutting edge fintech trends such as behavioural scoring. This means that you only invest in loans of people who have sufficiently proved to us that they can repay the loan.

-

2. Dynamic diversification

We use an innovative algorithm to match your investments with loans. We match investments with all existing loans on the platform and rematch them dynamically. Each time a new loan is approved, you as a lender obtain a share in this loan. As a result, the return of your capital does not depend solely on a particular number of borrowers. Instead, your capital is constantly moving to attempt to maximise the chance of return and minimise the risk of loss. In this way, the risk is also spread among all investors at the platform, which lowers the potential amount of capital loss.

-

3. If a loan defaults, our Provision fund should repay both your capital and expected returns

Even though we check the borrower’ creditworthiness, some borrowers may stop repaying their loans for some reason. For such cases, we will operate a Provision fund. The Provision fund aims to substitute all repayments that are more than 2 months late. The fund should cover the full repayment amount and so you should get back both your invested capital and expected interest.

-

In case the borrower isn’t able to continue repaying the loan, the Provision fund either continues to repay the missed repayments or we (PeerCredit Ltd) terminate the loan and repay the whole remaining loan amount to the lenders at once. In such cases, we are able to take the debt recovery action.

- The Provision fund will be created by the initial deposit of PeerCredit and will be regularly added to - a particular proportion of the interest paid by each borrower repayment is transferred to the fund. The proportion depends on the overall risk level of the borrower. We will keep the fund separate from our business accounts and it is used only for repayments of defaulted loans and related debt-recovery fees.

Lender’s rate

-

The interest rate on your investment depends on the market situation. Each approved borrower receives an offer with an interest rate that is set based on their risk level and the loan term. All lenders at PeerCredit earn the same interest rate, as they all have a share in all existing loans and carry the risk together. On average, your returns can hover from 5% up to 15% but as stated before, the final rate depends on the loans made.

- We display the current investor’s rate on our Home page as well as on the Lender’s main page. As a registered lender, you can find the current lender’s return in your account. So you can easily and at any time access the information your earnings for that day.

How you can access your investments

-

Thanks to the innovative matching of loans and investments, you can withdraw your invested money instantly if there are enough funds in the lending pool. Your share in the loans will be simply redistributed among other lenders. The specific amount that can be instantly withdrawn may vary over time depending on the situation on the platform. We display the amount available for instant withdrawal in your personal account at PeerCredit. So each time you would like to withdraw your investment, you can find exact information about how much is available.

-

In case there are insufficient free funds in the pool, you can make a withdrawal request and it will be queued with other requests from other investors. As soon as there is enough liquid cash in the pool, your withdrawal will be automatically completed.

- Please be aware that according to the current legislation we must check the identity of lenders. Therefore, we will ask you to verify your email address and phone number and to provide us with a copy of your identity documents and proof of address.

What are the risks

We do our best to provide our lenders with the maximum possible risk mitigation of their investments. However, despite the multiple mitigation mechanisms, please be always aware that your invested capital is at risk and instant access is not guaranteed. There is also no FSCA protection on loans made.

Please read about the potential risks before you start investing here